As the reality of the FED’s firm hand sinks in, disgruntled traders operating in discombobulated markets will relax. We may have violent moves in both level and shape, but as the risk of a 1930’s depression or a Zimbabwe inflation dims, risk vectors will slide back into their longer-term ranges.and this:

We have not changed our view. [T]he average yield of the Treasury 10yr over the past six years is 4.16% with considerable congestion at the 4.0% level. Using any combination of Real GDP plus CPI, it is hard to see a Nominal GDP of much above 4% over the medium term. So there is our cap. Conversely, with over $2 Trillion of new Treasury supply and a Foreign Central Bank community eager to diversify away from the USDollar, breaching 3% seems unlikely under even the most dire economic circumstances. This means that although professional options traders may profit from “delta hedging” the relationship between Implied and Realized Volatility, true end-users should soon significantly reduce their usage of options as a hedging tool.Good thing black swans are just a figment of Nassim Taleb's imagination. Dear Harley - pretty charts and all, but aside from your axed position, is there anything factual you can provide aside from references to CNBC anchors who claim that the recession is over, or maybe a counterpoint to the claim that your firm only exists because Ben Bernanke had some early onset amnesia and didn't quite remember just why your new uber boss Kenny bailed all of you guys out in the last minute with your latent $15 billion in losses (and will eventually result in major civil lawsuits with huge monetary damages for BAC shareholders).

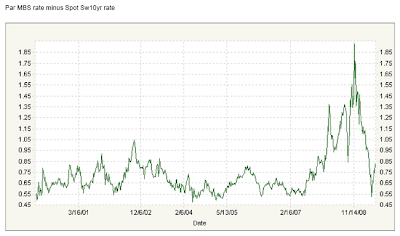

We agree with your observations that the market is pricing in virtually limitless Fed and Treasury support: if it wasn't, the S&P would be at or near 0. However, unless you assume the Socialist States of America will be the new appellation for this country in perpetuity, at some point one has to assume the removal of the backstops. Believing that the 3-4% UST range will be the "new normal" then is beyond naive. Instead of adding all the other fancy graphs (below), the most useful one to see would have been to show just how insane a 4-5% mortgage rate is in a historical timeframe, not just in the US but globally. After a credit bubble explosion with a magnitude in the tens of trillions, if there is one thing one can claim with certainty, it is that a range bound level is exactly what will never occur if the market equilibrium is allowed to be restored without the nudging power of the administration's printing presses.

Of course, for the sake of your new employer, whose fate does rest on "risk vectors sliding back into their longer-term ranges", and thus your ongoing paycheck receipts, we hope you are correct. We would be the last to suggest that a piece pushing the anti govie vol trade is in fact just the opposite of the trade that ML/BAC is currently putting on the books in anticipation of reality actually catching up (either with a bang or a whimper). On the other hand, when pundits make claims such as "In other words, the Black Swan has made his appearance and flown south for the winter" you know it is days if not hours before another massive unexpected event occurs and the southward migration of 6 sigmas rapidly reverses.

Pretty charts compliments of ML's RateLab:

Sphere: Related Content

Print this post

Sphere: Related Content

Print this post