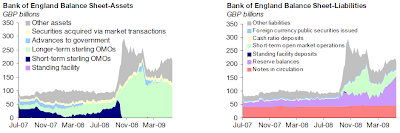

Comparing the balance sheets of the Federal Reserve, the Bank of England and the ECB indicates that certain shanningans by the former two (and particularly massive agency purchasing specifically by the former former) may be responsible for persistent weakness of their respective currencies to the detriment of a (hyper)inflation allergic Europe (America's brush with the Weimar Republic was luckily offset by 3,000 miles of salt water, and even the UK had the Chunnel to thank). The bottom line is that while the Fed and the BE's balance sheets continue expanding, that of the ECB has been in shrinkage mode for a while now. Behold:

Federal Reserve:

Bank of England:

European Central Bank:

The most curious thing is that the absent the half a trillion reduction in foreign bank liquidity swaps the Fed's balance sheet would be in the stratosphere. But the premise is Europe is stable so Bernanke can rein those in. Ironically the more pressured Europe is to take up America's and Britain's economic slack, the more pronounced will be the pressure on Europe, both fiscally and monetarily, resulting in yet another eventual round of liquidity swap bail outs (and that is without even mentioning the "Eastern European Question"). But for now America is happy (the dollar is getting pillaged) and a disorganized Eurozone is dropping deeper into deflationary chaos (has anyone heard a peep out of Raiffeisen Bank lately? - speaking of RZB, it is enough to note that a Google search of the bank results in the first two hits being its Czech and Russian subsidiaries). How long can this persist? For a direct answer, the best proxy may, ironically, be the S&P500 yet again. Keep a close eye: the unwind of the central bank balance sheet game theory defection race (as well as every other unwind) will manifest itself there first.

Hat tip Andy Dufresne who seems to have found a good internet connection in Zihuatanejo

Sphere: Related Content Print this post